Organization Size

billions CFA francs

billions CFA francs

billion CFA francs

billion CFA francs

Branches

Customers

The Orabank Group

Orabank: Committed, Bold, with you

The Orabank Group is a citizen bank that listens to its clients and partners, working to create a new model where the bank provides a responsible service to its stakeholders and civil society.

Founded in 1988, Orabank is a group whose growth has been accelerated by both the acquisition of local and regional banks and sustained organic growth.

Since 2009, Orabank has grown significantly to a pan-African dimension of 12 countries of operation. This strong growth was accelerated by the acquisition of the Banque Régionales de Solidarité (BRS) network in 2013 and the consolidation of its establishment through the creation of banks in West and Central Africa.

Oragroup is an official signatory to the United Nations Principles for Responsible Banking – a unique framework for a sustainable banking sector developed through a partnership between banks around the world and the United Nations Environment Program’s Financial Initiative (UNEP FI).

Since 2022, the group has joined the PRB (Principles of Responsible Banking), the first UN global partnership with the global financial community dedicated to understanding, integrating, and advancing the sustainable finance agenda.

In a context of profound change, the Orabank Group continues to ensure that it meets the best international standards in management, particularly in governance. In this regard, we recognize the primacy of risk management.

Cheikh Tidiane N’DIAYE

Deputy Managing Director

The Orabank Group is very proud to be part of this unique international network, allowing us to publicly show our commitment to responsible investment, a more sustainable financial and banking system for society, contribute to the goals of a sustainable future for future generations, adopt and create best environmental and social practices and standards, and become the drivers of a cultural change that will make a difference in the long term. Our group has always defended financial inclusion and the highest ethical values. Not being part of that initiative was not an option.

Ferdinand NGON KEMOUM

Ferdinand NGON KEMOUM

Products and Services

An expanded range of banking products and services

Orabank entities have universal banking activities centered around Retail Banking, Banking or Large Companies and Digital Banking.

Head office

392, Rue des Plantains

B.P. 2810 – LOME

TOGO

Tél : +228 22 23 05 80

Fax : +228 22 20 48 51

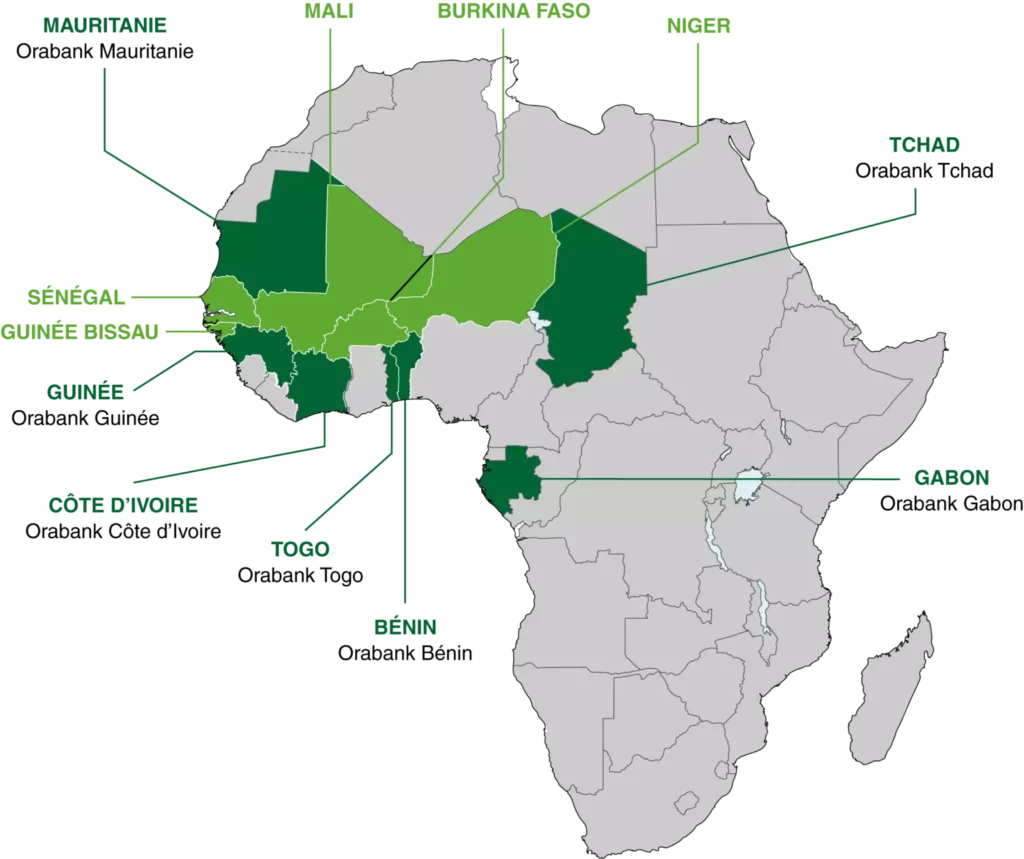

Presence in countries

A local presence for growth

The Financial BC Group was created in 2000 in Lomé. Following a series of creations and acquisitions, the Orabank group is now present in 12 countries in West and Central Africa, spread over four currency areas: Benin, Burkina Faso, Côte d’Ivoire, Chad, Gabon, Guinea, Guinea-Bissau, Mali, Mauritania, Niger, Senegal and Togo) through the Orabank network.

In 2011, the group changed its name to Oragroup SA. Oragroup takes the form of a public limited liability company (SA) under Togolese law. The Group’s strong growth was enabled by the acquisition of the network of Regional Solidarity Banks (RSBs) in 2013.

| Countries | Branches | Staff | Active Customers |

|---|---|---|---|

| Benin | 16 | 249 | 65,066 |

| Ivory Coast | 12 | 212 | 29,150 |

| Gabon | 9 | 174 | 45,908 |

| Guinea Bissau | 8 | 139 | 37,645 |

| Guinea | 20 | 209 | 63,897 |

| Mali | 10 | 150 | 34,054 |

| Mauritania | 9 | 128 | 14,292 |

| Niger | 11 | 150 | 41,369 |

| Senegal | 13 | 238 | 26,700 |

| Chad | 11 | 175 | 30,272 |

| Togo | 40 | 462 | 295,856 |

| Holding | 74 | ||

| TOTAL | 171 | 2,510 | 717,486 |

We capitalize on the development of the experience and agility of our sales forces in order to maintain our quality of service standards and ensure the commercial development of our activities. We will continue to differentiate ourselves by the performance of our internal processes, especially on the subjects of digitalization. It is also the consideration of these issues that will generate the value that we redistribute, among other things, to our shareholders. That’s how we build the capacity to maintain our market share and to gain new market share.

Julien KOFFI

Sales and Marketing Director, Orabank Group

Legal form

A stable shareholding basis

Oragroup is a holding company with participation financial constituted under the form of a Public Limited Company with a Board of Directors and registered at the Lomé Trade Register under No. 2000 B 1130.

Capital of 69,415,031,000 CFA francs.

The Orabank Group is majority-owned by Emerging Capital Partners (ECP), an investment fund dedicated to the African continent.

Since ECP Financial Holding’s acquisition in 2008 and the change of name in Oragroup, the Group has gradually acquired a universal bank size to become a reference pan-African banking group.

Oragroup held its ordinary general meeting on 31 May 2023 in Lomé, in order to approve the financial statements of the company for the financial year ended 31 December 2022, published in accordance with the international IFRS standard.

Stages of growth

Since 2008, the Orabank Group’s size has increased nine-fold thanks to strong organic growth and successful acquisitions.

1988 | Start of our activities in Benin

|

1992 | Opening in Chad

|

2002 | Getting Started in Gabon and Guinea

|

2003 | Opening in Togo

|

2009 | Acquisition by ECP of 100% of Financial BC SA

|

2009 | Acquisition of a minority stake in BACIM Mauritanie

|

2011 | Financial BC SA becomes Oragroup SA

|

2011 | Financial Bank becomes Orabank

|

2012 | Oragroup takes the majority of BTD’s capital

|

2013 | Acquisition of the BRS Group

|

2014 | The banks of the BRS Group become Orabank

|

2015 | Merger of Orabank Togo and BRS Togo, merger of Orabank Benin and BRS Benin

|

2019 | Introduction to the BRVM on April 16, 2019 at 4,100 CFA francs per share

|

2020 | Deployment of KEAZ, our digital banking platform

|

2021 | Association with Axian to accelerate financial inclusion in Africa

|

2022 | Obtaining Intermediary Management Company accreditation for Oragroup Securities, which will provide a new quality of service experience for clients

|